b&o tax states

The Manufacturing BO tax rate is 0484 percent 000484 of your gross receipts. The total state and local tax burden on Alaskans including income property sales and excise taxes is just 510 of personal income the lowest of all.

Washington State Sales Use And B O Tax Workshop

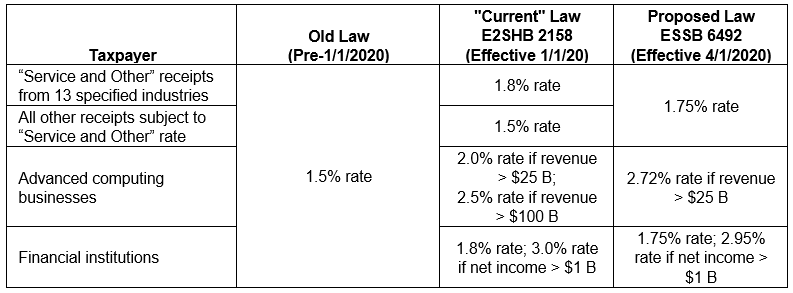

Service and Other Activities.

. However wireless taxes have increased by 50 percent from 151 percent to 226 percent of the average bill. Since 2008 average monthly wireless service bills per subscriber have dropped by 26 percent from 50 per line to about 37 per line. At the end of 2019 over 67 percent of low-income adults had wireless as their phone service and 58.

The Washington Policy Center an independent public-policy think tank says the BO is nationally recognized as one of. Our BO tax tripled when that went away he notes. Alaska has no state income or sales tax.

During the August 13th and 14th weekend the states 625 sales tax will be. Business and occupation tax overview. The most common convention for-profit enterprises use is to account for the credit related to previously paid payroll taxes as a loss recovery.

This article authored by Scott Schiefelbein and Robert Wood 2 provides helpful tips regarding some of the nexus traps the BO tax poses for the unwary company seeking to do business in Washington and was originally published in the spring issue of the Oregon State Bar Taxation Section Newsletter. If youre unsure how your business is classified the Department of Revenue provides a list of common business activities and their corresponding tax classification s. The tax amount is based on the value of the manufactured products or by-products.

The Manufacturing BO tax rate is 0484 percent 000484 of your gross receipts. A Business and Occupation Tax is imposed on any persons s engaging or continuing with the state in any public service or utility business except railroad railroad car express pipeline telephone and telegraph companies water carriers by steamboat or steamship and motor carriers. For products manufactured and sold in Washington a business owner is subject to both the Manufacturing BO Tax and the Wholesaling or Retailing BO Tax.

The major classifications and tax rates are. When the loss recovery becomes probable under Accounting. Business and Occupation Tax.

WEST SPRINGFIELD Mass. This bill enacts a 7 tax on capital gains exceeding 250000 effective January 1 2022. Tax burdens rose across the country as pandemic-era economic changes caused taxable income activities and property values to rise faster than net national product.

Washington State BO Tax Treatment. Under GAAP for-profit enterprises have several allowable accounting conventions to record the ERC credit. Washington is the only state in the country that taxes businesses this way.

Tax burdens in 2020 2021 and 2022 are all higher than in any other year since 1978. However on May 4 2021 Washington Governor Jay Inslee signed Senate Bill 5096 into law in an effort to make the Washington tax system more equitable to all residents. Washingtons BO is an excise tax.

The new tax is expected to generate nearly 415 million in revenue for the state. In some cases the local sales tax rate can be higher than the state sales tax rate. See total tax burden by state state and local taxes.

So when youre comparing sales tax rates from state to state look at both the combined state and local sales tax. For products manufactured and sold in Washington a business owner is subject to both the Manufacturing BO Tax and the Wholesaling or Retailing BO Tax. According to the Tax Foundation the five states with the highest average combined state and local sales tax rates are.

WWLP This years tax free weekend for Massachusetts is right around the corner. The tax amount is based on the value of the manufactured products or by-products.

Banner Oak Nebo Tee Large In 2022 Tees Nebo Best Sellers

Business And Occupation B O Tax Washington State And City Of Bellingham

N508kz Boeing 747 Thai Airline Boeing

Washington State Sales Use And B O Tax Workshop

B Amp O Tax Return City Of Bellevue

When Are Washington S Business Occupation B O Taxes Due 2021 Youtube

Washington State Sales Use And B O Tax Workshop

Thai Airways International Mcdonnell Douglas Md 11 Landing At Hong Kong Kai Tak Thai Airways Mcdonnell Douglas Md 11 Douglas Aircraft

Washington Department Of Revenue Delays Implementation Of New B O Tax Surcharges Service Rate Increase Coming Instead Perspectives Reed Smith Llp

Boeing 39 S Jumbo Milestone The 1 500th 747 Boeing Passenger Aircraft Boeing Aircraft

B Amp O Tax Guide City Of Bellevue

Washington Business And Occupation Tax Does Not Need Physical Presence For Nexus

50 First B O Passenger Diesel Painted For Abraham Lincoln Service On Subsidiary Chicago Alton Baltimore And Ohio Railroad Alton Train